Home

Why do you want to repair your credit? Have you been denied credit? Or are you being charged high interest rates, which is costing you a lot of money?

There were such abuses in credit reporting that the federal government gave consumers certain rights to be able to legally challenge credit reporting agencies to remove any erroneous and negative accounts appearing on you reports.

What are the benefits of having good credit? Having good credit means that you can be approved for the credit you need when you need it. With good credit you will:

- Not be denied credit

- Qualify for low or no down payment or deposit requires

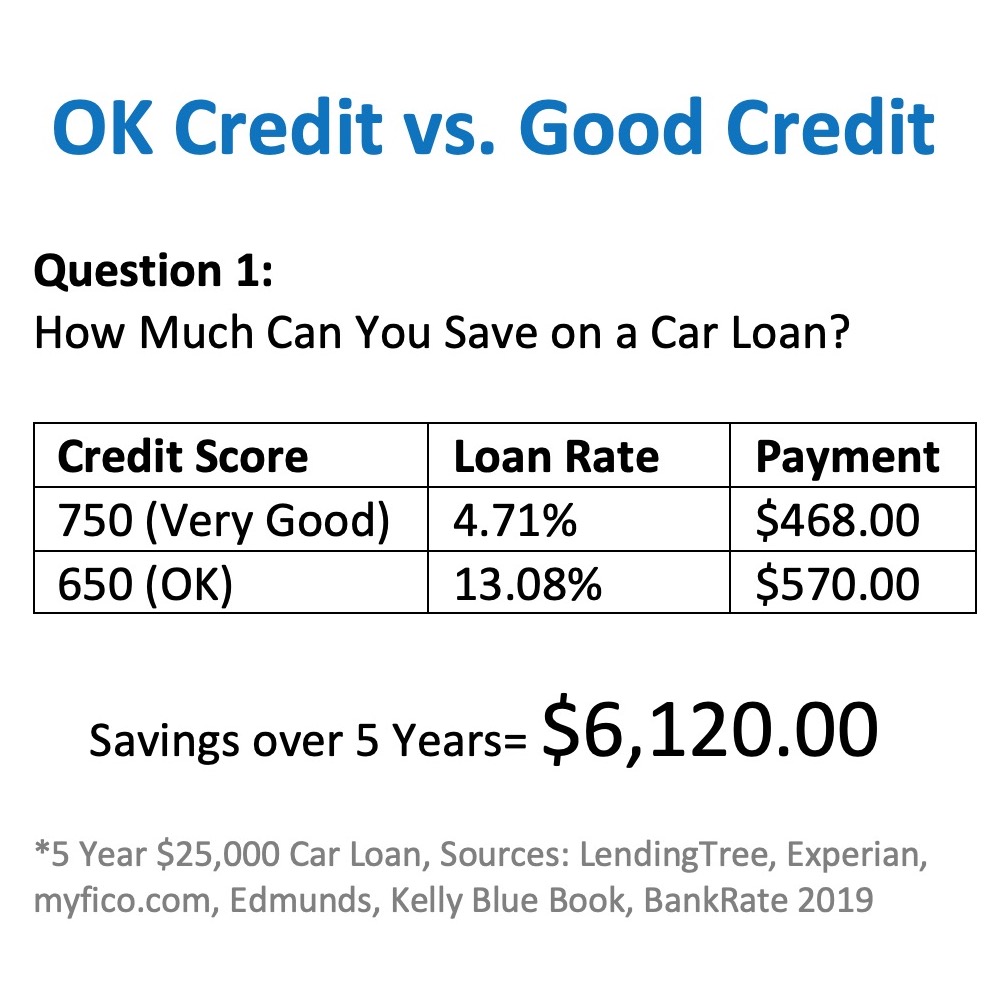

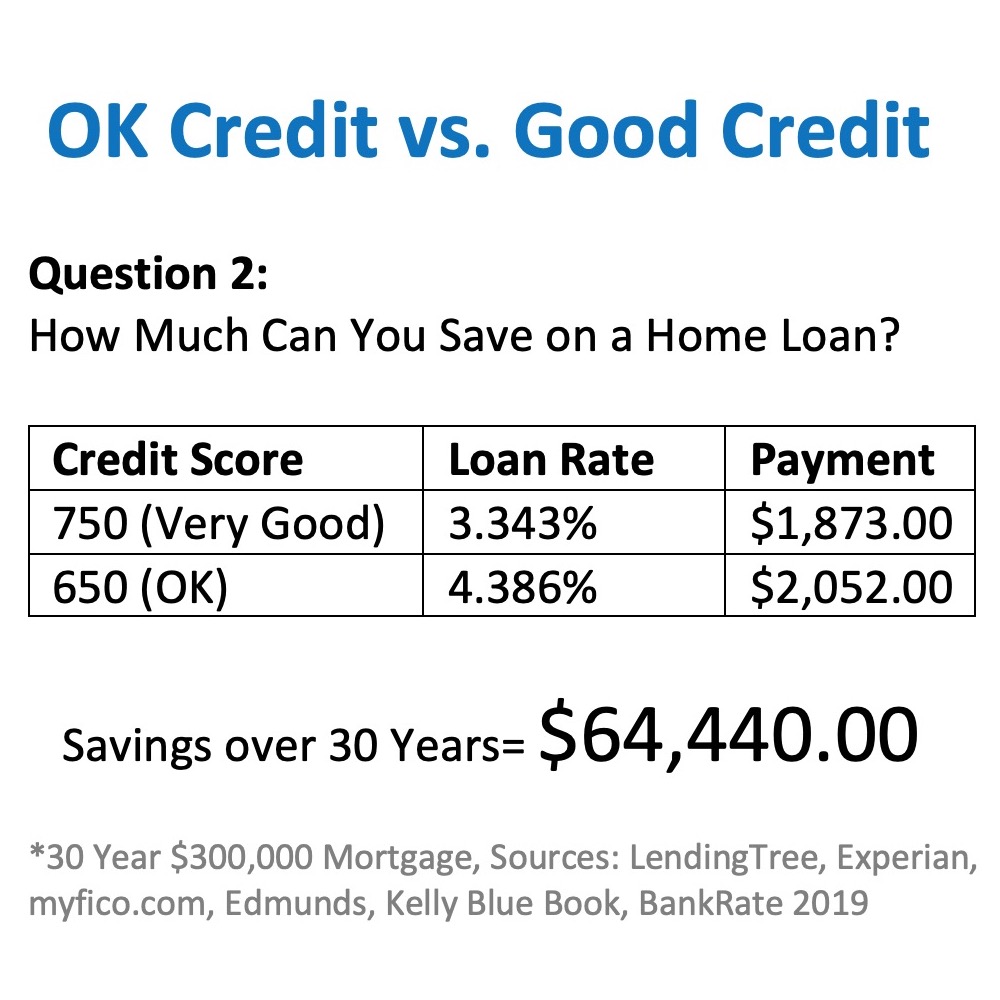

- Qualify for low interest loans, which can save you thousands of dollars over the term of the loan.

- Qualify for 0% balance transfer cards. Reducing the amount you pay in interest on your high interest credit cards.

- If an emergency comes up you can access the credit you need without fear of being denied.

Here are some examples of how much you can save by repairing your credit.

When considering repairing your credit you will want to consider several factors.

Value: Most full service credit repair companies charge on-going monthly fees. What they don’t tell you is that they can take as much as 12-18 months to repair your credit.

Effectiveness: Be sure that when you are trying to repair your credit that you use a company that files legal disputes. Many times when people attempt to dispute items on their own, they can actually do more damage.

Simple: Credit can be complicated. Many times trying to do it yourself can be confusing, frustrating and then you simply give up..

Time to see results: Many of the full service credit repair companies, which are paid monthly, are in no hurry to fix your credit. It can be drawn out over 12-18 months in some cases.

Track record: Be sure to check out the track record of any company you choose to fix your credit. There are many scams out there you should be aware of and steer clear of..

Warranty: Do they offer a warranty? Legitimate companies will stand behind the effectiveness of their program or service. If they don’t beware.

Our pick for one of the best credit repair programs is offered by the Consumer Information Bureaus